vermont state tax withholding

Tax Withholding Table. If the Amount of Taxable Income Is.

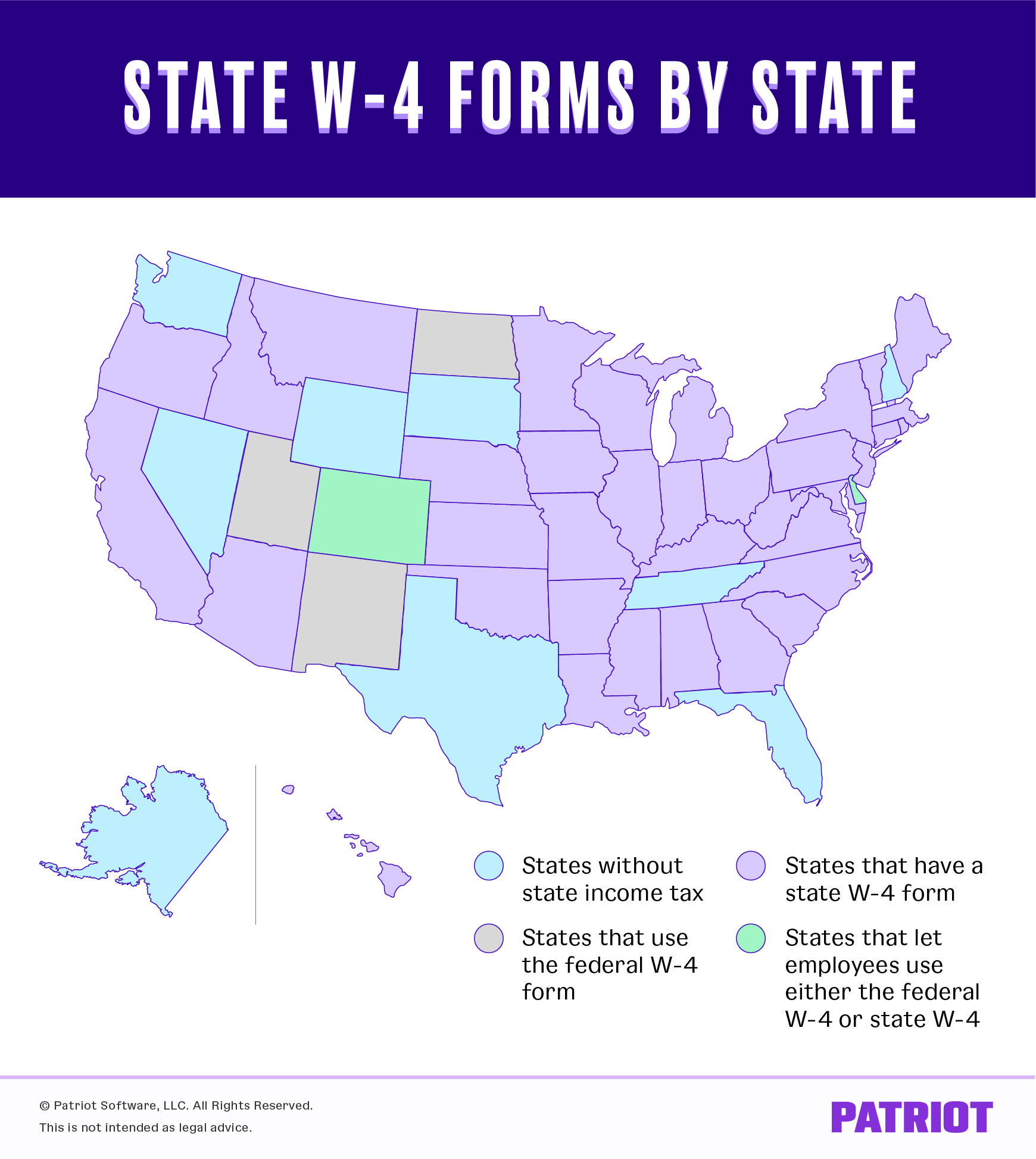

State W 4 Form Detailed Withholding Forms By State Chart

The filing status number of withholding allowances and any extra withholding.

. Vermont has a progressive state income tax system with four brackets. Single or Head of Household. In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing.

The annual amount per allowance has changed from 4400 to 4500. Vermont Tax Adjustments and Nonrefundable Credits. If the Amount of Taxable Income Is.

When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding. Payments subject to Vermont tax withholding include wages pensions and annuities. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

Overview of Vermont Taxes. The income tax withholding for the State of Vermont includes the following changes. The Amount of Vermont Tax Withholding Should Be.

Individuals Personal Income Tax Withholding. The annual amount per exemption has increased. Ad Access IRS Tax Forms.

The Single or Head of Household. Vermont Credit for Income Tax Paid to Other State or Canadian Province. Complete Edit or Print Tax Forms Instantly.

Plan the correct withholding rate is 6 of the deferred payment. The amount of the tax is 25 of the gross. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

Tax Withholding Table. Vermont Income Tax Withholding. The states top income tax rate of 875 is one of the highest in the nation.

If Federal exemptions were used and there are additional withholdings proceed to step 8. The Amount of Vermont Tax Withholding Should Be. 8 rows The income tax withholding for the State of Vermont includes the following changes.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the. To help employers calculate and withhold the right. The income tax withholding for the State of Vermont includes the following changes.

Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. The withholding is based on both the deferred payment and any income that may be derived from the deferred. Single or Head of Household.

Other payments are generally subject to Vermont income tax. IN-151 Application for Extension of. Form W-4VT Employees Withholding Allowance Certificate 1983 KB File Format.

If Federal exemptions were used and there are additional withholdings proceed to step 8. Up to 25 cash back File Scheduled Withholding Tax Payments and Returns. Download or Email VT WHT-434 More Fillable Forms Register and Subscribe Now.

The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. The annual amount per allowance has changed from 4350 to 4400. In Vermont there are three main payment schedules for withholding taxes.

Vermont Income Tax Withholding is computed using the Vermont withholding tables or wage bracket charts.

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

Vt Dept Of Taxes Vtdepttaxes Twitter

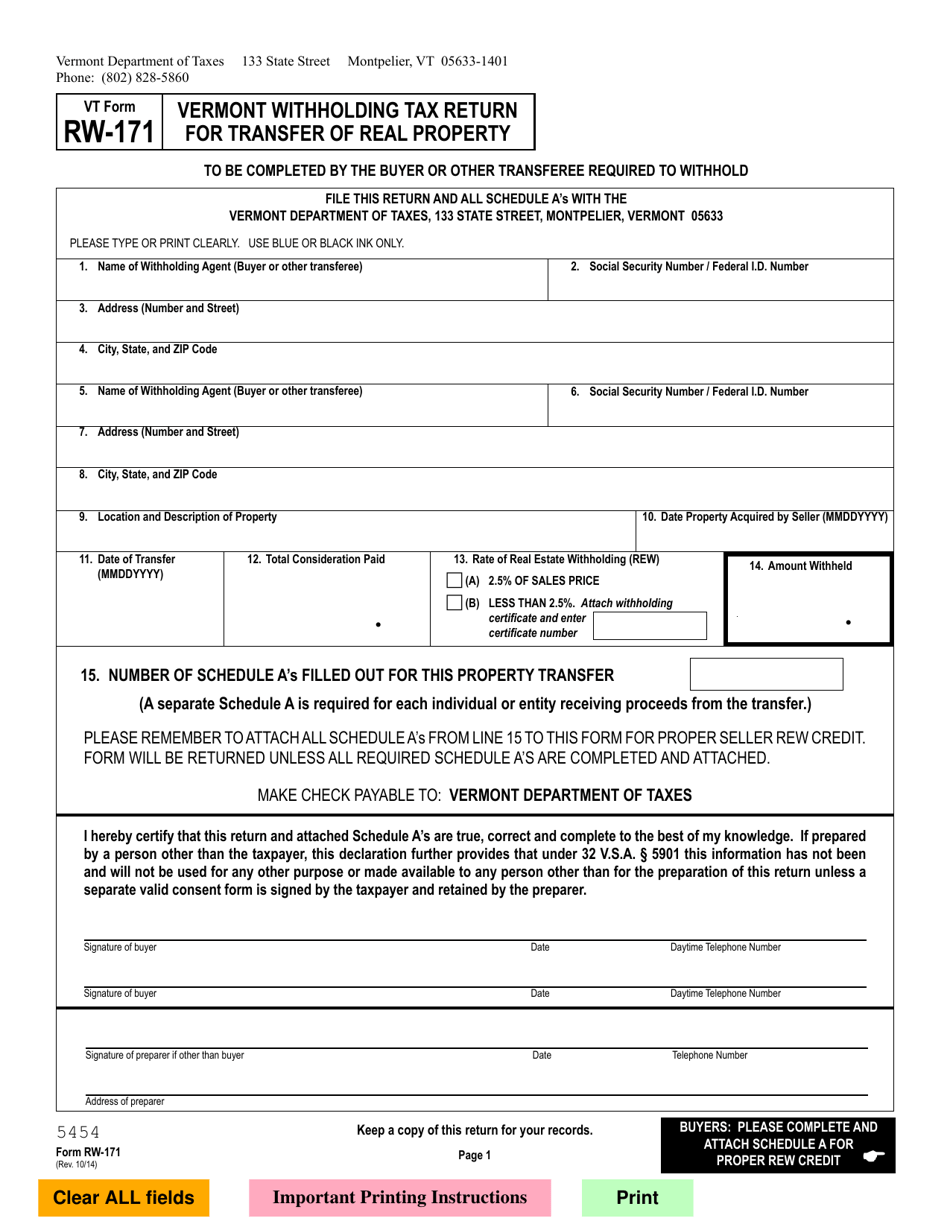

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Department Of Taxes Facebook

State Income Tax Rates Highest Lowest 2021 Changes

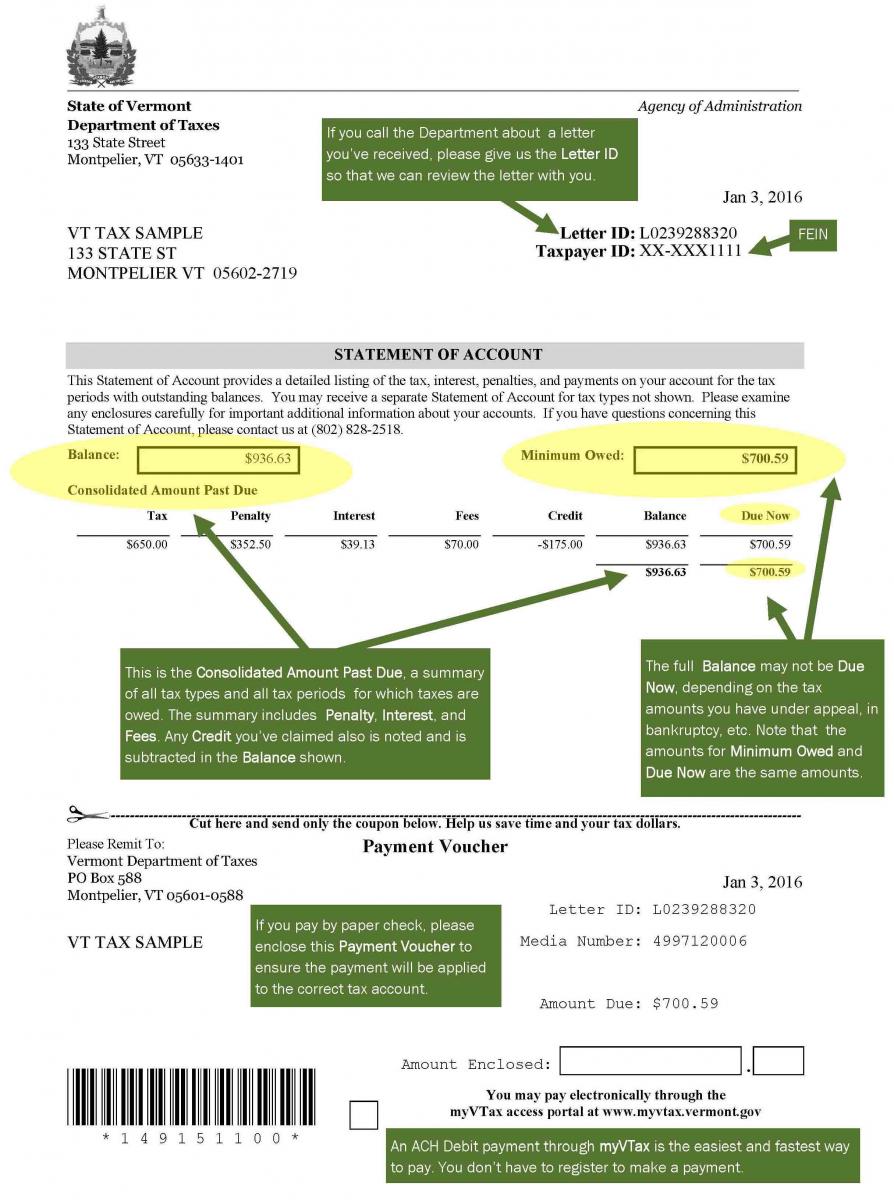

Your Tax Bill Department Of Taxes

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

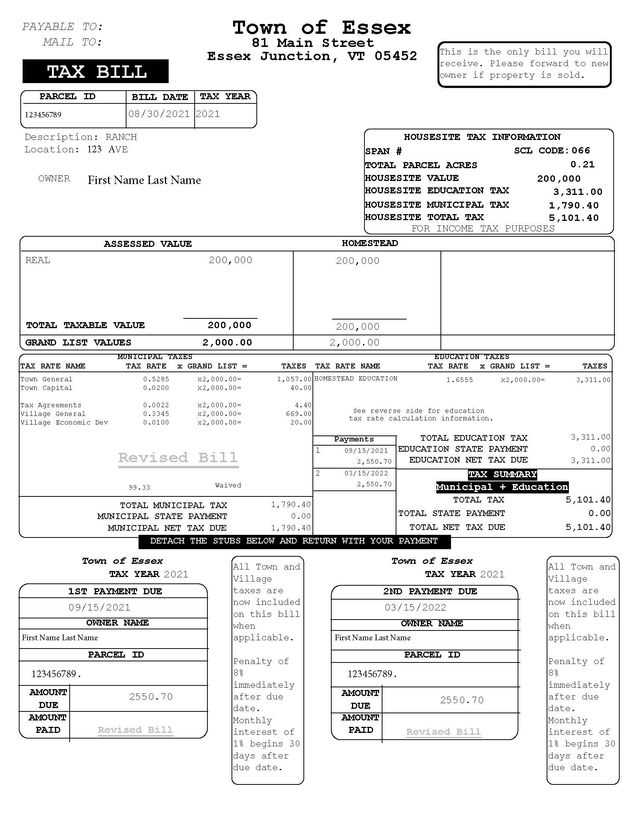

Real Estate Taxes Burlington Vt Peet Law Group

State W 4 Form Detailed Withholding Forms By State Chart

What Are State Payroll Taxes Payroll Taxes By State 2022

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation